Analysis of Tuesday's Trades

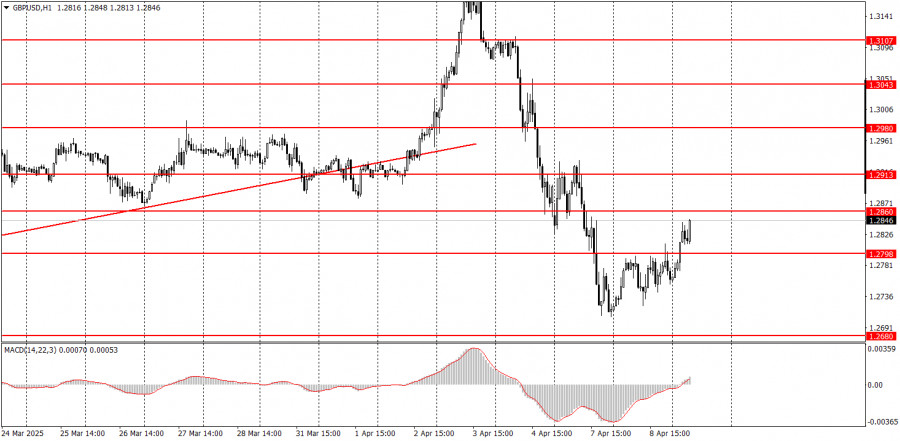

1H Chart of GBP/USD

On Tuesday, the GBP/USD pair traded with a slight upward bias. There were no major news events throughout the day, and only in the evening did news emerge about increased tariffs on China, which triggered a renewed rise in the pair. After a 500-pip drop in the pound, assuming the uptrend is over would be premature. Trump can easily "fix" this issue. At this point, we're almost afraid to imagine how far Trump might go—but watching the situation unfold is becoming fascinating. Whereas many once aspired to get to the U.S. and be part of its economy, more and more people are now trying to stay away. A recession is forecasted for the U.S.; in our view, that might not even be the worst outcome. Trump has gone all-in, showing no concern for the economic consequences, while taking joy in victories at the golf club. In short, the dollar's decline continues, and the trade war keeps escalating.

5M Chart of GBP/USD

On the 5-minute chart, at least three solid signals were formed on Tuesday. The price bounced twice from the 1.2791–1.2798 zone and once from the 1.2723 level. In two out of three cases, the target level was reached. The third trade likely closed at breakeven via a Stop Loss. Thus, even on relatively modest intraday movements, one could have earned around 70–80 pips on Tuesday.

Trading Strategy for Wednesday:

On the hourly chart, GBP/USD should have started a downtrend long ago, but Trump continues to do everything to bring the dollar down. Since the official start of the global trade war, we no longer attempt to predict long-term movements. On Friday, we witnessed a sharp decline in the pair that could be the beginning of a substantial correction. However, the market remains under Trump's control and decisions. Once Trump announces new tariffs, the dollar falls again. And who still believes this will be the last escalation?

On Wednesday, GBP/USD may remain volatile and stormy. Predicting where the pound and dollar will go today is nearly impossible. For now, the pair is rising fairly logically, and this upward move is likely to continue throughout the day.

On the 5-minute chart, you can trade using the following levels: 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3225, 1.3272.

There are no scheduled significant events in the UK or U.S. on Wednesday, but rest assured—significant developments will likely surface during the day. Volatility is expected to remain high, and the U.S. dollar has a strong chance of registering another decline.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.