Wall Street hit: Markets sway after Trump's tariff maneuvers

US stock markets were in a state of panic on Thursday, with key indexes falling sharply and the S&P 500 losing more than 3%, putting investors on high alert. This came just after temporary tariff concessions announced by President Donald Trump the day before sparked short-term optimism that gave way to a new round of uncertainty.

Risky asset capitulation: gold soars, dollar hits rock bottom

Market participants' fears quickly transformed into a flight to a "safe haven." Investors began actively buying gold, as a result of which the price of the precious metal rose by almost 3%, updating its historical highs. At the same time, the US dollar came under strong pressure, reaching a decade-low against the Swiss franc, another traditional safe-haven asset.

Treasury bonds stabilize panic

Amid volatility and concerns about global trade, US government bonds began to recover their positions. Most yields fell slightly, and a successful auction on Thursday added confidence in stable demand amid turbulence. This is especially important against the backdrop of sharp sell-offs in Treasuries observed earlier in the week.

Trade uncertainty thickens the clouds

Despite temporary concessions, the White House made it clear that the confrontation with China continues. Donald Trump has confirmed his intention to tighten tariffs on Chinese imports, as well as maintain a 10% duty on almost all shipments to the United States. According to information from the administration, the combined pressure of tariffs on Chinese goods has reached a record 145%.

Positive macroeconomic data did not save from sell-offs

Even despite the unexpected decline in consumer prices in March - a signal that in other conditions could have encouraged investors - the markets ignored the statistics and continued to fall. This shows how high the anxiety is and how much influence geopolitical factors have on the behavior of players.

Earnings season is approaching: banks at the start

The financial community is waiting with bated breath for the start of the corporate reporting season in the United States. On Friday, the country's largest banks, including JPMorgan Chase, are scheduled to present their quarterly results. Given the escalation of tariff rhetoric, these reports can become a critical indicator of the stability of the corporate sector in a turbulent background.

After the storm, a new wave: markets are rocked by Trump's nighttime decision

The financial world found itself on a swing again: Donald Trump's announcement of massive tariffs, made late in the evening on April 2, shook up the markets. The announcement, which became an unexpected denouement in the protracted trade drama, immediately caused price surges and a sharp change in investor sentiment.

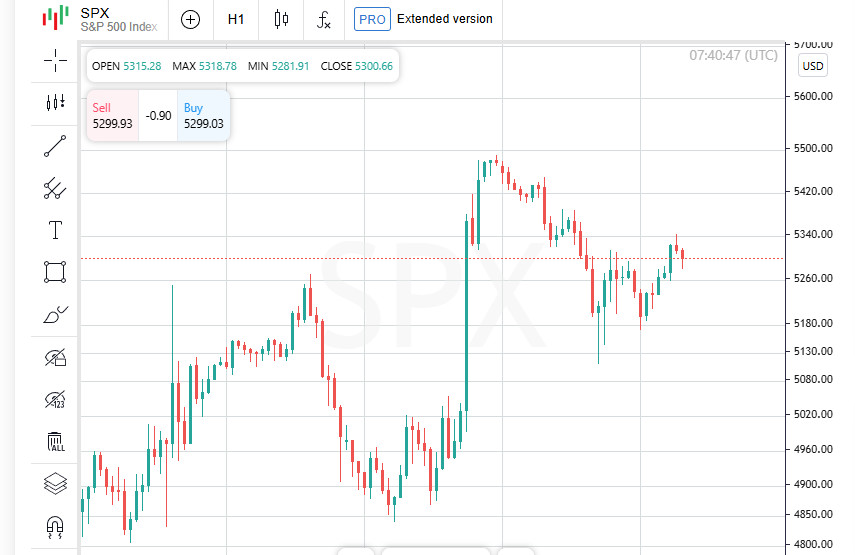

US indices are collapsing: S&P 500 is losing ground

After a rapid rise on Wednesday, an equally rapid collapse followed on Thursday. As a result of such fluctuations, the S&P 500 index ended up 7.1% below the level it was at before the mutual tariff announcement made last week.

The Dow Jones fell 1,014.79 points, or 2.5%, to close the day at 39,593.66. The S&P 500 index fell by 3.46% to 5,268.05, while the tech-heavy Nasdaq showed the biggest drop: minus 737.66 points, or 4.31%, reaching 16,387.31. The world felt the alarm bells: the global MSCI index fell by 0.77%, which added fuel to the fire in an already unstable situation.

The world is recovering: Asia and Europe are catching a breather

It is interesting that, simultaneously with the fall of American stock exchanges, foreign markets reacted to Washington's steps more optimistically. Trump's cancellation of some tariffs on Wednesday served as a trigger for the growth of foreign stocks.

The pan-European STOXX 600 index soared by 3.7%, reflecting a surge in confidence among European investors. The Asian region also saw significant gains, with markets in Tokyo, Shanghai and Seoul quickly catching on to the positive momentum, hoping for an easing of pressure in international trade.

The EU takes a step back — but with an eye on negotiations

The European Union responded quickly to the tariff pause. The head of the European Commission, Ursula von der Leyen, said that the bloc was suspending the introduction of retaliatory measures against American products. Brussels views the 90-day respite as a chance to resume negotiations and find compromise solutions. Thus, a diplomatic window is opening — the question is how sustainable it will be.

Currency swings: the dollar in free fall

Amid tariff news, the American currency continued to lose ground. The dollar depreciated especially sharply against the Swiss franc, falling by 3.89% to 0.825, which became a new alarm signal for the markets. The euro strengthened by 2.23%, and the Japanese yen also added: the dollar fell by 2.07%, falling to 144.66 yen.

Investors Go Borrowing: Demand for Treasuries Rises Amid Turbulence

Despite the raging market storm, the US Treasury Department on Thursday recorded strong interest in selling 30-year Treasuries. This was a continuation of strong demand for 10-year bonds the day before and eased concerns about a possible decline in investor interest in American debt.

Panic in the Stock Market: Margin Calls and Hedge Funds Put Pressure on Yields

Experts note that the sudden jump in bond yields at the beginning of the week was triggered by massive sell-offs. Under pressure from losses and margin calls, asset managers and hedge funds rushed to liquidate positions. The result is a wave of market capitulation that sent yields soaring.

China in Focus: Possible US Treasury Sell-Off Spooks Markets

In addition, speculation is growing about Beijing's position. As one of the largest holders of US bonds, China could theoretically start selling off some of its portfolio amid the deepening conflict with Washington. For markets, such a move would be a powerful destabilizing factor, worsening an already nervous situation.

Yields retreat slightly, but anxiety remains

As of the close of trading, the yield on 10-year government bonds fell by 1 basis point to 4.386%. Two-year bonds, more sensitive to the Fed's interest rate policy, fell by 11 basis points to 3.843%. As is well known, yields and bond prices move in opposite directions.

Oil slows down: growth gives way to a sharp fall

Oil prices, which had previously shown a revival, have rolled back. American light crude (WTI) fell by $2.28, settling at $60.07 per barrel. Brent, the global benchmark, also slid, losing $2.15 and falling to $63.33. Thus, energy, which was bet on as an indicator of recovery, came under pressure again.

Gold is back in the spotlight: anti-risk goes to heaven

Investors, frightened by the escalation of the conflict between the US and China, continue to seek protection in gold. The spot price of the metal soared by 2.6%, reaching $3,160.82 per ounce, after having updated the historical maximum of $3,171.49 during the session. A clear signal: the market is preparing for a long storm.

Reorganization of strategies: the dollar is losing ground, markets are shaking

Amid global turmoil, markets are increasingly betting on assets not linked to the dollar. Worries about a sharp cooling of the global economy and growing trade tensions between the world's largest powers are destroying old patterns of investor behavior. Abandonment of usual strategies has become the new norm, with currency and debt markets at the epicentre of a restructuring of global capital.

Europe in anticipation: a lackluster opening, but currencies are already raging

European stock markets are preparing for a calm start, but the backdrop is far from neutral. Futures on the main indices are signaling a subdued opening of the session, while currency movements are becoming increasingly dramatic. The Swiss franc is storming the heights: the currency has reached a peak not seen since 2015. The Japanese yen is also confidently gaining, becoming the strongest in the past six months.

Gold knows no fatigue: a new march to the top

Gold continues to strengthen, as if it is the focus of all the anxiety of world markets. Investors, abandoning the dollar, are increasing pressure on the precious metals market, pushing the price to new records. As gold hits high after high, it becomes a litmus test for global anxiety.

Euro Returns to Pre-War Levels

The currency swings have taken the euro to territory it has not conquered since February 2022. The market is interpreting the current macro- and geopolitical signals as a reason to move away from the dollar and revalue the European currency. The euro's strength is another indicator of a shift in global capital flows caused by instability in the United States and ongoing trade tensions.

The dollar is losing ground: the sell-off continues

On the currency front, the dollar is under fire again. The merciless sell-off continues: investors are dumping the American currency and government bonds as toxic assets in a crisis portfolio. The consequences are a sharp rise in Treasury yields: 10-year bonds reached 4.444%, and if the trend continues, this will be the largest weekly gain since 2001.

Records on the Horizon: 30-Year Notes at the Center of Turbulence

Longer-term U.S. bonds are also under intense pressure. The 30-year yield is set for its biggest weekly jump since at least the early 1980s. Such large moves indicate that the market is deeply worried, and the current tension goes far beyond short-term speculation.